Over the past year, the rate for a 30-year fixed-rate mortgage has more than doubled. While home prices aren't decreasing at a similar pace, the increase in what it costs to borrow money has had a major impact on affordability and buyer qualification.

Let's run some numbers to see just how much this rate movement has affected buying power.

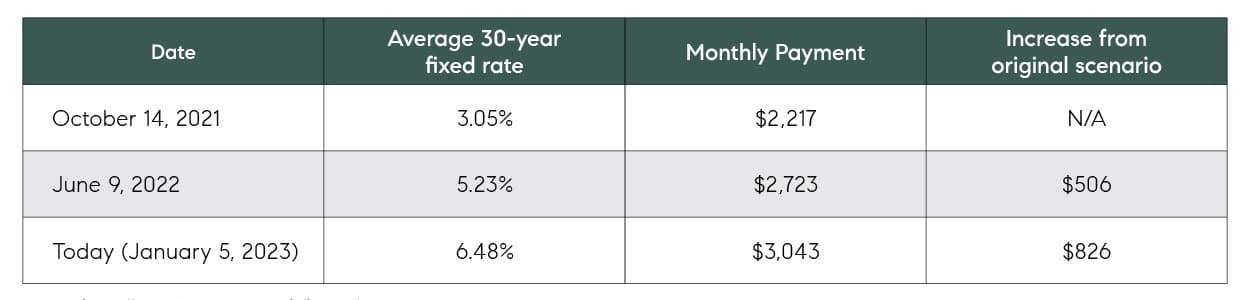

Here's what a monthly payment on a $1.2M mortgage would look like for a $1.5M home purchase ($300k, 20% down payment) over the past year.

This borrower went from being able to afford a $1.5M home to a $1.175M home—a 22% reduction—in just a short matter of time.

Buyers are feeling this and need all the support they can get right now. A tough market calls for a tough team. We can help find other ways to boost buying power.